Can a loan be considered an expense?

One possibility is that loan payments could be classified as operating expenses. This would be the case if the loan was used to finance day-to-day business operations, such as purchasing inventory or equipment.

A loan isn't revenue or income — it's an obligation, and so it will show up on a company's balance sheet as an obligation, while the payments on the loan will appear as a payment, specifically usually under the heading of interest expense, in the income statement.

The total loan payment itself is not an Expense, but a combination of the liability reduction and interest expense. Business Credit Cards are also a liability. The payments to the credit card company are not expenses, they are a reduction of a liability.

You are simply paying back the money you borrowed, not spending money in any way you can write off. However, you may still be able to make some deductions. Interest paid on your business loan is tax-deductible in most cases. Specifically, you can write the interest portion of your payments off as a business expense.

A loan is an asset but consider that for reporting purposes, that loan is also going to be listed separately as a liability.

An interest expense is the cost incurred by an entity for borrowed funds. Interest expense is a non-operating expense shown on the income statement. It represents interest payable on any borrowings—bonds, loans, convertible debt or lines of credit.

Banks have general assets just like businesses and individuals. These assets make money for the bank. For instance, cash, interest-earning loan accounts, government securities, etc. Loans are important assets for banks because they generate revenue from the interest that the customer pays on these loans.

First, expense accounts are typically used to track money that is spent on business-related costs. This means that if you're looking at a personal bank account, it's unlikely to be an expense account.

When calculating a profit and loss account, not every type of expense or revenue should be recorded. Expenses on assets and cash injections such as loans opens in new window or loan repayments are usually excluded.

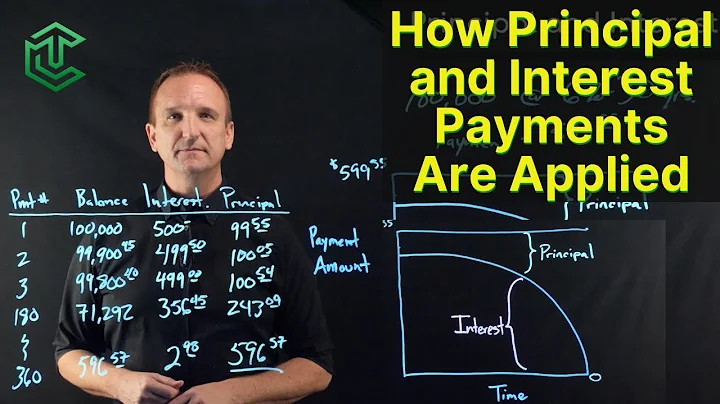

If you're recording periodic loan payments, you'll start by applying the payment toward the interest expense. You'll then debit the remaining amount to the loan account. This will result in a reduction of the balance you have outstanding, and then the cash account will be credited to record the cash payment.

Is loan an indirect expense?

As a cost unrelated to any type of manufacturing, loan interest expenses qualify as indirect expenses.

The personal loan payments you make are not tax deductible. The money you receive isn't income, and repaying the principal balance won't affect your taxes one way or the other. You won't even need to include the loan or file any extra forms with your tax return.

They can be rent, outstanding bills, credit card debt, owed taxes, and loans. There are two classifications of loans in QuickBooks Online: current liabilities and long-term liabilities.

A company lists its long-term debt on its balance sheet under liabilities, usually under a subheading for long-term liabilities.

All loan payments have two transactions: the negative transaction of money leaving your bank account and the positive transaction of money paid towards the debt, decreasing what you owe. The negative transaction should be categorized as the expense, so your budget will reflect your spending on that category.

Both fixed and variable expenses can be reduced, but cutting fixed expenses may require bigger life changes. Examples of fixed expenses are mortgage payments, car payments, student loan payments, and subscription fees. Examples of variable expenses are utilities, food, dining out, entertainment, and travel.

Example of Loan Payment

Let's assume that a company has a loan payment of $2,000 consisting of an interest payment of $500 and a principal payment of $1,500. The company's entry to record the loan payment will be: Debit of $500 to Interest Expense. Debit of $1,500 to Loans Payable.

Fixed expenses are the predictable, recurring costs that typically stay the same in your budget from month to month. Common fixed expenses include: Mortgage or rent payments. Loan payments (car loans, student loans, personal loans)

Common misperceptions. A lot of people think of loans only as a liability, not an asset, because having a loan means you owe something. But to the person who is owed that money, the loan is an asset. Banks count loans as assets because they are a store of value for them.

If you loaned money to someone, that loan is also an asset because you are owed that amount. For the person who owes it, the loan is a liability.

Is a loan classified as an asset?

A loan may or may not be a current asset depending on a few conditions. A current asset is any asset that will provide an economic value for or within one year. If a party takes out a loan, they receive cash, which is a current asset, but the loan amount is also added as a liability on the balance sheet.

An expense is a cost that businesses incur in running their operations. Expenses include wages, salaries, maintenance, rent, and depreciation. Expenses are deducted from revenue to arrive at profits.

You cannot claim the costs of work-related penalties or fines. Examples of these would be late fees on tax returns or parking or speeding tickets incurred in the course of doing business.

The Profit and Loss statement will only display the interest you pay on your loans, not the principal. This is because the interest is the only portion of the loan payment that is expensable, meaning it will affect your net profit. Your total interest can be seen in the Interest Expense line.

Loan repayments make the company suffer some costs to cater for the interest fees; therefore, expenses in the company increase, which are part of the losses in the company. Therefore, additions are made on the losses side in profit and loss statements when there are loan repayments.

References

- https://cfoallianceinc.com/blog/build-strong-balance-sheet/

- https://en.wikipedia.org/wiki/Balance_sheet

- https://www.quora.com/How-do-I-tell-if-a-company-is-profitable-from-a-balance-sheet

- https://www.imf.org/external/pubs/ft/mfs/manual/pdf/mmfsch4.pdf

- https://www.investopedia.com/terms/a/accounting-equation.asp

- https://www.bellinghamwallace.co.nz/news-insights/what-does-a-strong-balance-sheet-look-like-why-is-it-important/

- https://corporatefinanceinstitute.com/resources/accounting/balance-sheet/

- https://www.brex.com/journal/what-are-liquid-assets

- https://www.investopedia.com/ask/answers/062415/which-financial-statements-does-company-report-its-longterm-debt.asp

- https://www.nerdwallet.com/article/small-business/accounts-receivable-financing

- https://whatafigure.com/how-to-read-a-balance-sheet/

- https://gocardless.com/guides/posts/non-current-liabilities-definition-and-examples/

- https://www.versapay.com/resources/accounts-receivable-debit-credit

- https://groww.in/p/tax/rules-of-accounting

- https://www.investopedia.com/articles/stocks/07/bankfinancials.asp

- https://online.hbs.edu/blog/post/how-to-read-a-balance-sheet

- https://www.accountingtools.com/articles/quick-assets

- https://www.thrivent.com/insights/investing/what-are-3-of-the-main-types-of-asset-classes

- https://www.freshbooks.com/hub/reports/profit-and-loss-report

- https://www.forbes.com/advisor/personal-loans/are-personal-loans-taxable/

- https://societyinsurance.com/blog/what-is-the-difference-between-a-balance-sheet-and-an-income-statement/

- https://turbotax.intuit.com/tax-tips/irs-tax-return/taxable-income-vs-nontaxable-income-what-you-should-know/L0h4j5DZQ

- https://www.investopedia.com/terms/c/collateral.asp

- https://www.freshbooks.com/hub/accounting/accounting-loans-receivable

- https://www.zoho.com/books/guides/how-to-read-a-balance-sheet.html

- https://www.startuploans.co.uk/business-guidance/profit-and-loss-account-explained/

- https://www.sage.com/en-us/blog/5-things-you-wont-find-on-your-balance-sheet/

- https://www.wallstreetmojo.com/interest-income/

- https://www.business.com/articles/boost-balance-sheet/

- https://tipalti.com/accounting-hub/what-is-a-balance-sheet/

- https://homework.study.com/explanation/where-are-loans-and-advances-classified-on-a-balance-sheet.html

- https://help.bkper.com/en/articles/2569185-loan-receivable

- https://www.linkedin.com/pulse/how-often-should-companies-perform-financial-analysis-tristan-wright-qxspc

- https://www.investopedia.com/ask/answers/112415/are-personal-loans-tax-deductible.asp

- https://www.bfi.co.id/en/blog/piutang-adalah-definisi-jenis-contoh-dan-perbedaanya-dengan-hutang

- https://www.open.edu/openlearn/money-business/introduction-bookkeeping-and-accounting/content-section-3.6

- https://smallbusiness.chron.com/accounting-errors-affect-balance-sheet-60918.html

- https://www.fdic.gov/resources/supervision-and-examinations/examination-policies-manual/section3-8.pdf

- https://www.investopedia.com/articles/04/031004.asp

- https://byjus.com/question-answer/bank-loan-is-shown-in-the-equity-and-liabilities-side-of-balance-sheet-under-the/

- https://www.csus.edu/indiv/v/vangaasbeckk/courses/135/sup/bankbal.pdf

- https://www.scotpac.com.au/blog/asset-finance-vs-personal-loan-whats-the-difference/

- https://www.investopedia.com/terms/l/liability.asp

- https://www.bankrate.com/loans/small-business/write-off-repayment-of-business-loan/

- https://www.freshbooks.com/hub/accounting/loan-repayment-accounting-entry

- https://www.marketwatch.com/guides/personal-loans/taxes-on-personal-loans/

- https://www.investopedia.com/ask/answers/122414/net-income-same-profit.asp

- https://www.bankrate.com/loans/personal-loans/do-personal-loans-affect-your-tax-return/

- https://www.octet.com/blog/what-is-a-healthy-balance-sheet/

- https://fournierabservices.com/when-an-expense-isnt-an-expense/

- https://www.businessinsider.com/personal-finance/are-personal-loans-taxable-income

- https://www.indusind.com/iblogs/categories/manage-your-finance/is-current-account-a-liability-or-an-asset-for-banks/

- https://www.thestreet.com/investing/balance-sheets-the-good-the-bad-and-the-in-between-10371340

- https://www.highradius.com/resources/Blog/accounts-receivable-assets-liability/

- https://www.growthforce.com/blog/4653/general/balance-sheet-liabilities/

- https://www.investopedia.com/articles/stocks/08/successful-company-qualities.asp

- https://oboloo.com/blog/what-is-not-an-expense-account/

- https://positivemoney.org/how-money-works/advanced/introduction-to-balance-sheets/

- https://www.investopedia.com/ask/answers/050615/what-items-balance-sheet-are-most-important-fundamental-analysis.asp

- https://agiled.app/hub/accounting/what-is-loan-receivable/

- https://help.paloalto.com/hc/en-us/articles/115004889808-How-LivePlan-s-financial-statements-handle-loans-and-other-financing

- https://www.creditmantri.com/forum-is-loan-repayment-an-expense/

- https://www.investopedia.com/terms/o/obsf.asp

- https://ramp.com/blog/writing-off-business-expenses

- https://smallbusinessresources.wf.com/creating-a-profit-and-loss-statement/

- https://www.investopedia.com/terms/i/incomestatement.asp

- https://www.rate.com/resources/assets-to-include-mortgage-application

- https://www.universalclass.com/articles/computers/how-to-manage-loans-in-quickbooks-online-version.htm

- https://www.junafinancial.com/understanding-balance-sheets-guide/

- https://www.universalcpareview.com/ask-joey/what-is-the-journal-entry-to-record-a-loan-from-a-bank-owner-related-party-or-any-other-entity-that-is-unaffiliated-with-the-company/

- https://www.sba.gov/blog/5-things-know-about-your-balance-sheet

- https://corporatefinanceinstitute.com/resources/accounting/financial-statement-manipulation/

- https://gridlex.com/a/delinquency-st31/

- https://www.investopedia.com/ask/answers/121514/what-difference-between-pl-statement-and-balance-sheet.asp

- https://www.accountingcoach.com/blog/principal-payment-financial-statement

- https://homework.study.com/explanation/which-of-the-following-transactions-violate-the-balance-sheet-equation-select-all-that-apply-a-increase-a-liability-and-increase-a-revenue-b-increase-cash-and-reduce-contributed-capital-c-increase-an-expense-and-reduce-a-liability-d-reduce-cash-an.html

- https://www.quora.com/What-is-the-difference-between-an-account-receivable-and-a-loan

- https://www.3ecpa.co.in/blog/recording-loans-receivable-in-accounting-books/

- https://www.accountingcoach.com/blog/interest-principal-loan-payments

- https://happay.com/blog/balance-sheet/

- https://ttlc.intuit.com/community/retirement/discussion/how-should-i-categorize-a-business-loan-not-the-repayment-of-principle-or-interest-but-the-lump-sum/00/2972839

- https://www.patriotsoftware.com/blog/accounting/balance-sheet-problems/

- https://www.investopedia.com/terms/i/interestexpense.asp

- https://english.stackexchange.com/questions/534347/what-should-i-call-a-balance-sheet-that-doesnt-balance

- https://quickbooks.intuit.com/learn-support/en-us/help-article/loans/set-loan-quickbooks-online/L7pMR6rUN_US_en_US

- https://www.penair.org/faq/how-do-i-categorize-loan-payments-and-transfers/

- https://www.waveapps.com/blog/how-to-manage-loan-payment-journal-entries

- https://www.investopedia.com/terms/e/expense.asp

- https://www.experian.com/blogs/ask-experian/do-you-have-to-pay-income-taxes-on-personal-loans/

- https://financialmodelling.mazars.com/top-10-ways-to-fix-an-unbalanced-balance-sheet/

- https://quickbooks.intuit.com/learn-support/en-au/help-article/sales-logistics/track-loan-customer/L2ibeiGw2_AU_en_AU

- https://www.xero.com/uk/glossary/liabilities/

- https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/ap-financial-sector/financial-assets-ap/a/lesson-summary-financial-assets

- https://agicap.com/en/article/bad-debt/

- https://homework.study.com/explanation/how-do-loan-repayments-show-up-on-the-p-l.html

- https://www.financestrategists.com/accounting/financial-statements/balance-sheet/current-assets/is-a-loan-a-current-asset/

- https://www.workspace.co.uk/content-hub/business-insight/understanding-your-accounts-the-profit-and-loss-a

- https://www.investopedia.com/terms/d/double-entry.asp

- https://www.brex.com/journal/how-to-make-a-balance-sheet

- https://www.investopedia.com/ask/answers/040915/what-considered-good-net-debttoequity-ratio.asp

- https://www.investopedia.com/financial-edge/1012/useful-balance-sheet-metrics.aspx

- https://www.investopedia.com/ask/answers/062915/what-types-assets-may-be-considered-balance-sheet-obs.asp

- https://www.freshbooks.com/hub/accounting/good-liquidity-ratio

- https://www.indeed.com/career-advice/career-development/indirect-expenses

- https://www.quora.com/On-an-income-and-expense-statement-is-the-money-I-received-from-a-loan-considered-an-income-or-an-expense

- https://www.openriskmanual.org/wiki/Loan_or_Advance_against_Receivables

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/understanding-balance-sheets

- https://secure.clearbooks.co.uk/community/questions/12962/what-s-quot-loans-payable-quot-vs-quot-loans-receiveable-quot

- https://www.sfu.ca/~mvolker/biz/balsheet.htm

- https://dart.deloitte.com/USDART/home/publications/deloitte/additional-deloitte-guidance/roadmap-ifrs-us-gaap-comparison/chapter-1-assets/1-1-investments-in-loans-receivables

- https://www.sofi.com/learn/content/fixed-vs-variable/

- https://www.investopedia.com/terms/a/asset.asp

- https://courses.lumenlearning.com/oldwestbury-wm-macroeconomics/chapter/banking-profits-and-losses-name/

- https://cle.law.unc.edu/wp-content/uploads/2023/03/3-Understanding-a-Bank-through-its-Financial-Statements-Sparks.pdf

- https://www.experian.com/blogs/ask-experian/how-to-budget-for-fixed-and-variable-expenses/

- https://homework.study.com/explanation/which-of-the-following-is-not-a-part-of-investing-activities-a-buying-a-building-b-collecting-on-a-loan-receivable-c-borrowing-money-d-selling-off-equipment.html

- https://www.liveflow.io/post/notes-receivable

- https://www.geeksforgeeks.org/adjustment-of-interest-on-loan-in-final-accounts-financial-statements/

- https://www.quora.com/Why-is-a-loan-considered-an-asset-for-a-bank-if-there-is-a-risk-of-it-not-being-paid-Isnt-that-a-liability

- https://www.linkedin.com/pulse/how-loan-affects-your-financial-statements-

- https://corporatefinanceinstitute.com/resources/accounting/interest-expense/